01 Is Direct Operation the Only Solution?

2024: A Challenging Year for Physical Retail

The retail industry continues to face challenges in 2024.

Data shows that in the first half of the year alone, nearly 7,000 stores closed, with over 70% of long-established department stores shutting down. Sales in department stores and specialty brand stores fell by 3.0% and 1.8%, respectively, reflecting an unmistakable downward trend.

Where does the future of retail stores lie?

Amidst the overall decline, brands like MINISO and Pangdonglai have managed to sustain strong growth.

MINISO aims to offer consumers the “ultimate shopping experience,” inspiring other enterprises to emulate its meticulous retail practices. Similarly, Pangdonglai has shifted its focus entirely to “serving customers,” becoming a transformation model for many supermarkets.

If “customer-centricity” is the key to growth, why do so few succeed in implementing it effectively?

To deliver consistent and reliable service, both MINISO and Pangdonglai have adopted a direct operation model. However, due to cost pressures and market expansion challenges, most brands still rely on dealership models.

In traditional dealership models, brands serve dealers, and dealers serve consumers, often treating the dealers as their primary customers. This creates service gaps and fractures in the customer experience, as dealers are not the end-users of the product.

Some emerging brands, like NIO, have abandoned dealership models altogether to ensure a seamless customer experience. From sales to after-sales service, NIO relies predominantly on directly operated stores.

The question is:

How can brands operating in the traditional dealership model, which has historically driven massive success in markets like China, adapt to deliver superior customer experiences without alienating their extensive dealer networks?

02 A Massive Ship Turning Course

As a billion-dollar “aircraft carrier” enterprise, Haier operates a vast physical retail network encompassing three brands—Casarte, Haier, and Three-winged Bird—with six store formats and over 10,000 stores nationwide.

These stores are operated by Haier’s network of thousands of dealers and service providers, supported by 33 micro-enterprises and 500+ local grids nationwide.

However, Haier faces the same challenges inherent in the dealership model. Its large scale and diverse distribution channels result in inconsistent store performance and complex stakeholder dynamics.

Zhou Yunjie, Chairman of Haier Group, emphasizes:

“The user is always right. Haier does not engage in price wars; we focus on value wars centered around the user experience.”

Improving the user experience has become an imperative.

In 2023, Haier began its journey to transform from a dealer-centric to a user-centric service model. This transition involves shifting from a B2B (business-to-business) to a B2B2C (business-to-business-to-consumer) approach—serving users directly instead of focusing solely on dealers.

But how can Haier optimize its vast network of stores to deliver a unified, superior user experience?

03 Starting with the User

When you step into a home appliance store, what are you looking for?

First and foremost, you want to quickly find the right product that suits your needs. However, research shows that few users achieve this easily:

- “The stores feel cluttered and overwhelming.”

- “Too many labels—it’s dizzying.”

- “The sales pitch feels like a product manual.”

- “The displays look unrealistic; no one’s home looks like this.”

From a user’s perspective, the cognitive load of navigating stores is incredibly high. They must jump between brands, decipher new technologies, and reconcile their choices with their home decor, often with significant stress.

Once a product is chosen, the next hurdle is pricing.

In dealership models, prices are negotiable. Users often visit multiple stores, probing for the lowest price and additional perks. Yet, even after securing a deal, they may feel uneasy, wondering if someone else got a better price.

This process burdens users with high cognitive, monetary, and time costs. On average, they visit stores three times before finalizing a purchase.

But the challenges don’t end there.

Post-purchase, concerns about after-sales service arise:

- “The installer didn’t call to follow up on the product performance.”

- “If I’m not buying, the salesperson isn’t responsive.”

- “A follow-up from sales would be a great touch.”

Every hurdle before a purchase leads to customer churn. Every disappointment post-purchase pushes customers further away.

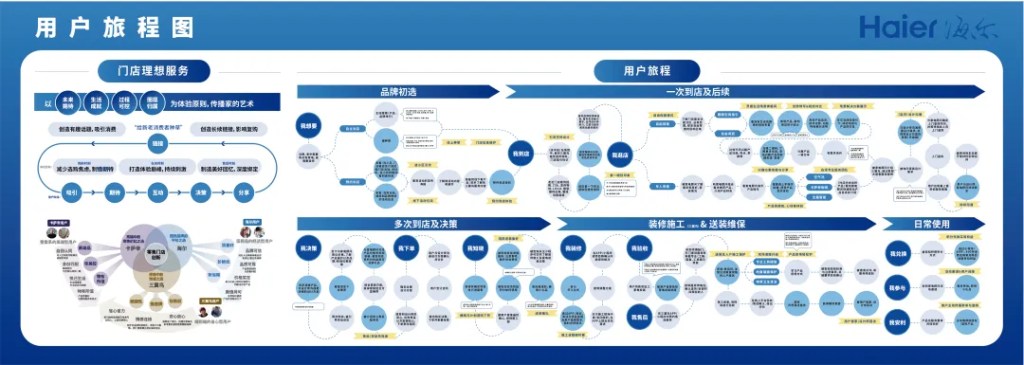

To address these issues, Haier worked with experts to redefine the ideal customer journey—reducing cognitive, monetary, and time costs while creating a seamless end-to-end experience.

04 Diving into the Deep End

Designing an ideal customer journey is one thing; implementing it across thousands of stores is another.

Haier’s internal structure is complex, with each department competing to showcase its priorities at retail stores. This results in a cluttered and confusing user experience. By aligning with a user-centric approach, Haier identified critical touchpoints to streamline resources and address bottlenecks.

Haier also redefined the positioning of its six store types to cater to diverse consumer segments, ensuring differentiation in strategies and execution.

Empowering Dealers and Partners

Empowering Dealers and Partners

Haier’s dealers and service providers vary in capabilities across social media operations, store coverage, warehousing, delivery, installation, and even live streaming. This variability directly impacts the execution of the ideal customer journey.

To address this, Haier has invested in a robust digital middle-office system, enabling end-to-end digital operations from R&D to manufacturing, marketing, logistics, and after-sales service. Tools like unified customer management systems and centralized warehousing and distribution help dealers improve user experience and efficiency.

For example, with centralized warehousing and distribution, Haier coordinates delivery schedules to match users’ renovation timelines, solving logistical challenges for both users and dealers.

05 Bringing the User Experience to Life

An ideal customer journey isn’t just a concept on paper. It must come alive in every store.

With China’s diverse market and user demands, no single journey map can address all scenarios. Haier integrates best practices from top-performing stores and adapts them to meet varied user needs.

To sustain this transformation, Haier mobilizes its entire organization—from management to store associates—to continuously create personalized, ideal user experiences.

06 Innovation Has No End

Haier’s journey demonstrates how a company can elevate user experiences and operational efficiency within the dealership model.

In 2024, Haier Smart Home reported revenues of ¥135.62 billion, up 3.0%, with net profits growing 16.3% to ¥10.42 billion. This success reflects the resilience of physical retail when businesses embrace disruption and reinvention.

As we navigate new economic cycles, two principles stand out:

- User-first: Create value and deliver the best experience.

- Efficiency: Achieve organizational alignment to unlock unstoppable momentum.

Together with Haier, we continue refining best practices, empowering partners, and enabling teams to deliver the ultimate user experience.

Service Design is not just about touchpoints, processes, or experiences—it is strategic decision-making that revitalizes organizations and breathes life into user journeys.